Ever found yourself wondering how projects align their costs with the value they deliver? Welcome to the world of the Finance Performance Domain that reframes cost management as a continuous value optimization process, not a one-time budgeting exercise, ensuring every dollar spent adds value.

This domain focuses on how organizations plan, allocate, control, and report financial resources to ensure that every investment in a project contributes meaningfully to the delivery of business value. It shifts the narrative from “Are we on budget?” to “Are we realizing the value expected from our investment?”

In this article, we explore the key concepts, governance mechanisms, and performance indicators that define the Finance Performance Domain, providing a blueprint for organizations that want to elevate their financial maturity and decision-making in projects.

What Is the Finance Performance Domain?

Performance Domains are interrelated areas of focus that together enable effective project delivery. The Finance Performance Domain ensures that a project’s financial resources are managed to maximize value realization and strategic alignment.

While earlier PMBOK editions treated finance primarily as “cost management,” PMBOK 8 integrates it with value-based decision-making, governance, and performance monitoring. This domain supports:

- Transparent allocation of financial resources,

- Continuous evaluation of return on investment (ROI),

- Accountability in spending and forecasting, and

- Proactive financial governance across project phases.

In essence, it ensures that financial decisions serve the strategy — not just the schedule.

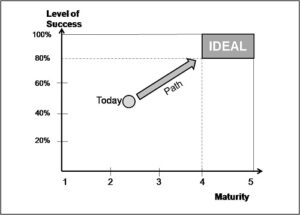

The Evolution from Cost Control to Value Management

Traditional cost management focused on variance tracking — monitoring the gap between planned and actual expenditures. PMBOK 8’s Finance Performance Domain goes further by embedding finance into the value delivery system.

It emphasizes three shifts:

- From Budgets to Benefits: Projects are measured by value outcomes, not just budget adherence.

- From Control to Insight: Financial performance is monitored to inform decisions, not only to enforce compliance.

- From Isolation to Integration: Finance is no longer an administrative process but a performance enabler connected to governance, risk, and scope domains.

By linking financial performance directly to business outcomes, PMBOK 8 ensures that project funding drives measurable strategic benefits.

Key Components of the Finance Performance Domain

PMBOK 8 describes this domain as a system of interrelated practices that govern financial decision-making throughout the project life cycle. The core components include:

1. Financial Planning and Forecasting

Financial planning establishes cost baselines, funding sources, and spending timelines aligned with project objectives. Forecasting ensures adaptability as circumstances change, allowing leaders to reallocate resources based on performance.

2. Budgeting and Resource Allocation

Budgets represent the financial embodiment of project priorities. This component focuses on ensuring the right amount of funding is available at the right time to support value creation.

3. Cost Control and Transparency

Continuous financial monitoring detects early deviations and triggers timely corrective action. Transparency ensures that decision-makers have accurate, current data to guide investments.

4. Value Assurance and Benefit Realization

Financial performance is assessed in terms of value achieved, not just money spent and costs saved. The organization measures benefits realized versus benefits forecasted and learns from variances.

5. Governance and Compliance

Clear governance structures define accountability, financial authority, and reporting protocols. Compliance with standards (PMI, ISO 21502, internal policies) ensures credibility and audit readiness.

These components collectively form a robust framework that supports strategic financial management and value maximization in projects.

The Relationship Between Finance and Value Delivery

In PMBOK 8’s integrated model, value delivery is the ultimate goal of all performance domains. Finance plays a central role in this system by connecting strategic intent to measurable results.

Organizations can enhance value delivery through financial performance adopting some strategies, such as:

- Prioritize Value-Added Investments: Focus on funding initiatives that promise the highest returns and strategic benefits.

- Implement Continuous Financial Monitoring: Regularly track financial metrics to ensure alignment with project objectives and make timely adjustments.

- Foster Stakeholder Engagement: Involve all stakeholders in financial decisions to ensure that value delivery is a shared goal.

These strategies not only help in managing costs but also ensure that the financial efforts contribute to achieving business objectives. By integrating financial performance with value delivery, organizations can drive success and sustain growth effectively.

Roles and Responsibilities in Financial Governance

Effective financial performance requires collaboration between governance bodies, project leaders, and sponsors.

| Role | Financial Responsibility |

|---|---|

| Executive Sponsor | Provide the strategic direction and ensure that financial governance aligns with broader business goals. Their involvement is key in setting priorities and approving budgets that reflect the organization’s value-driven mission. |

| Project Manager | Manages financial baselines, forecasts, and reports, balancing the budget while ensuring that financial resources are aligned with project objectives. Works closely with financial analysts to interpret data and adjust plans as necessary to remain on track. |

| Finance or PMO Analyst | Monitors cost trends, ensures transparency, and advises on corrective actions. Dive deep into the numbers, providing insights and forecasts that inform strategic decisions. Their analyses are crucial for identifying potential financial risks and opportunities for value enhancement. |

| Governance Board | Reviews investment decisions and benefit realization reports. |

| Compliance Officers | Ensure that all financial activities adhere to regulatory standards, safeguarding the organization against legal and financial repercussions. |

By distributing accountability across governance layers, it promotes financial ownership at every level and maximizes value.

Measuring Financial Performance

To deliver actionable insight, financial performance must be measurable, transparent, and timely. PMBOK 8 encourages the use of Finance Performance Indicators (FPIs) that go beyond simple cost tracking.

Key Metrics Include:

- Cost Performance Index (CPI): Measures efficiency of resource utilization.

- Cost Variance (CV): Indicates whether a project is on budget. A positive CV indicates that a project is under budget, while a negative CV suggests overruns.

- Estimate at Completion (EAC): Forecasts total project cost based on current trends.

- Benefit Realization Rate: Percentage of planned benefits achieved post-delivery.

- Value Efficiency Ratio: Ratio between realized value and actual cost.

- Return on Investment (ROI): Financial return relative to total investment.

- Net Present Value (NPV): Estimates the present value of future cash flows, helping to determine the potential profitability and financial sustainability of a project.

- Funding Variance Index: Measures adherence to funding plans across reporting periods.

These indicators transform financial management from static reporting to dynamic performance monitoring — supporting continuous decision-making.

Tailoring the Finance Performance Domain

PMBOK 8 emphasizes tailoring, ensuring that financial practices match the project’s size, complexity, and context.

| Project Type | Tailoring Approach |

|---|---|

| Predictive (Waterfall) | Detailed budgeting, earned value analysis, and strict cost baselines. |

| Agile / Iterative | Incremental funding, rolling-wave forecasts, and adaptive value tracking. |

| Hybrid | Combine periodic financial reviews with agile value assessments. |

Tailoring ensures that financial controls remain appropriate — rigorous enough to maintain discipline, yet flexible enough to foster innovation.

Integration with Other PMBOK 8 Domains

Finance connects directly with multiple performance domains ensuring a holistic approach to project management:

- Scope defines what will be delivered.

- Schedule aligns work and timing with approved funding.

- Resources ensures the resources are there to make it happen.

- Governance oversees whether funding decisions align with strategic outcomes. Defines financial authority, reporting cadence, and compliance.

- Risk identifies financial exposure and supports contingency planning.

Understanding these interdependencies helps organizations implement systemic financial governance, where every decision reinforces the others.

Challenges in Financial Performance Management

Organizations face recurring challenges in applying this domain effectively:

- Misalignment between budgets and value. Teams track costs but not benefits.

- Static budgets in dynamic environments. Financial rigidity conflicts with agile delivery.

- Limited financial literacy among project managers. Without basic understanding, financial data is underused.

- Insufficient governance integration. Finance is often isolated from strategic oversight.

PMBOK 8 addresses these issues by encouraging data-driven governance, cross-domain collaboration, and transparency.

Conclusion

The Finance Performance Domain in PMBOK 8 redefines financial management as a value-centric discipline. It integrates budgeting, forecasting, and performance monitoring into a cohesive system that ensures resources are used wisely and strategically.

When applied effectively, this domain turns finance into a driver of organizational success, ensuring every dollar invested in a project contributes to measurable, sustainable outcomes.

In the era of PMBOK 8, financial success is not about spending less — it’s about spending right to maximize long-term value.

Call to Action:

References

Project Management Institute (PMI). A Guide to the Project Management Body of Knowledge (PMBOK® Guide) – Eighth Edition. Newtown Square, Pennsylvania, USA: Project Management Institute, 2025. PMBOK Guide 8: The New Era of Value-Based Project Management. Available at: https://projectmanagement.com.br/pmbok-guide-8/

Disclaimer

This article is an independent educational interpretation of the PMBOK® Guide – Eighth Edition, developed for informational purposes by ProjectManagement.com.br. It does not reproduce or redistribute proprietary PMI content. All trademarks, including PMI, PMBOK, and Project Management Institute, are the property of the Project Management Institute, Inc. For access to the complete and official content, purchase the guide from Amazon or download it for free at https://www.pmi.org/standards/pmbok if you are a PMI member.